Best-in-Class Goal: 100% of Your Customers Buy

100% of Your Offers

Most Solution Providers have multiple solutions and service offers. In order to deliver a Best-in-Class return on each offering - and thus attain Best-in-Class growth and profit performance overall – you must sell enough of your services enough to consume the full delivery capacity of each service in which the company has invested. And, you need to do it in a specific way.

Low-performing Solution Providers often struggle to sell more than one, much less all, of their offerings to any given existing customer. As a result, in order to drive sufficient revenue for each of their solutions and services, they must obtain more new customers. These Solution Providers don't fully mine their existing customers by capturing the customer's entire IT "wallet", yielding optimal revenue per account. There are several unfavorable outcomes from this:

- It limits the effectiveness of Sales and Marketing. Because winning new accounts generally takes more time and effort than selling more to an existing one, the Solution Provider has to over-invest to secure each additional Revenue and Gross Margin dollar.

- Meanwhile, their under-utilized service capacity operates at sub-par gross margin, and because of the pressure to reduce resources, often sub-par quality.

- Because they consume less of each customer's available IT "wallet", it's easier for the customer to dismiss them, and more entry points in the IT budget are open to other Solution Providers.

- Lastly, the less a given customer consumes of the Solution Provider's offerings, the harder it is for the Solution provider to deliver a consistent, full service experience to the customer.

How the Top Performers Do It

Top-performing Solution Providers turn this approach around 180 degrees. Their first and foremost goal is to get every account to buy 100% of all their offers. This has multiple favorable effects:

- Faster revenue growth because fewer accounts are needed to attain a given revenue (and the sales cycle to existing customers is faster),

- Lower cost of sales per dollar of gross margin because less effort is needed to sell something to an existing account than a new one (and generally margins are higher),

- Each line of service is more likely to be used to capacity because selling is easier (this also helps service quality since there's enough margin to afford the right resources),

- It's harder to be dismissed by the client because the Solution Provider's departure leaves a bigger "hole" in the customer's operation, and

- It's harder for other Solution Providers to find an unfulfilled wedge in the customer's budget and use it to gain entry into the account.

That isn't to say top-performing Solution Providers don't hunt new accounts; they do. They just need fewer of them to reach a given revenue goal.

The Customer is Already Ready for This

It's important to remember that most customers have budget to spend all of your offers (or, at worst, most of your offers). They are spending it somewhere: With another provider or, in the case of Managed Services, perhaps internally on their own IT team. There isn't a good reason you can't capture all or most of that budget in all or most of your accounts.

The top performers do this very well. Their compensation plans incentivize 100% cross-selling. They don't just incentivize to get all service capacity consumed by any customers (i.e. either new or existing customers are fine). They know the most efficient way to grow and profit is to sell 100% of capacity (or very close to it) to existing customers.

The Prerequisite

There is a critical step to putting yourself in position to cross-sell 100% of your offers to 100% of your customers. That step is to choose what we call a "Target Customer Profile." That is, a customer size range narrow enough that you can narrow the range of products you sell, such that you can lessen the breadth and depth of services resources you need to serve customers.

To better understand this, let's look first at the end result we're trying to get in terms of service margin and quality.

A service team with best-in-class profitability and quality (whether project services, field services, Managed Services, or what have you), operates at high billable utilization, and does the same things over and over. The repetition enables high quality with lower-paid resources. Doing "one-off" services usually yields low margin, and quality relies primarily on the skill and motivation of the service person, as opposed to an efficient and effective service delivery methodology.

Bearing this in mind, let's compare two services teams:

-

Solution Provider A serves a single Target Customer Profile. Because of this narrower range of customer sizes, they only need to support one brand and model of firewall. As a result, they only need two, $80,000 engineers to handle the number of deals the sales team can sell in a year, and to be readily available during business hours (including training, sick, vacation, etc.) to do projects for customers.

-

Solution Provider B services a wider range of customer sizes, and thus needs to sell and support two different models of firewalls. Because these two firewalls are sufficiently different from each other, they need four (not two) engineers. Two engineers for each model of firewall, to provide responsiveness to the sales team.

Here's the rub. The limiting factor is how many firewall deals the sales team can close in a year. Let's say, in the case of both Solution Providers, both sales teams can sell 50 firewall deals a year. And, let's say it takes 50 firewall deals to keep two engineers fully utilized.

In the case of Solution Provider A, there's a happy result: Fifty deals keep the two engineers fully utilized. And because they know they're going to do 50 deals, Solution Provider A is likely to invest in tools, documentation and automation. This makes those 50 installs easier, and possibly even make them do-able by lower skilled engineers, which means $60,000 a year each, instead of $80,000.

Solution Provider B, however, is in a lower margin and lower quality position. Their 50 deals keep the four engineers busy only half the time. Gross margin is low. Because each team does only 25 repetitions, each will have less practice, and will have less incentive to build tools, documentation and automation. All of which means quality will be more dependent on the individual engineers and not the methods, and it will be hard to hire lower cost engineers.

There are partial workarounds:

-

Hire two engineers who can handle both the simpler and more complex firewalls. But half the deals will be staffed with engineers who are more costly than they need to be. And likely those engineers will be unhappy working on "simple" systems, and be more likely to leave.

-

Hire a total of three engineers, one more senior and two more junior, and try to make do. Yet, 50 deals only support two engineers, not three. So, we still have a margin problem, and probably quality and engineer retention issues.

All of this because the limiting factor is, and always will be, how many deals marketing and sales can deliver. There are never enough. All other things being equal, if sales could deliver 100 deals, Solution Provider B would still be less profitable and lower quality than Solution Provider A.

Lower service quality has a double consequence. Of course, the customer is unhappy, which results in less repeat business, fewer referrals and generally a damaged reputation. It's hard to imagine any worse consequences, but there's this: The sales team will lack the confidence to sell more services, even at a discount, and even with high incentives.

The problem is compounded when spread across the entire technology stack: two firewalls, two server architectures, two wireless architectures, two storage architectures, etc.

All because we choose to try to sell and deliver to a customer size range which is too wide to be served with a single architecture in each of these layers of the stack.

The commonly held, but false wisdom is that if we carry more different products, we can say "yes" more often, and therefore we can grow faster. When your business plan includes increasing the volume, quality and margin of services being sold, the exact opposite is true. The narrower the range of products you sell, the more likely the service team will be highly utilized, which results in more gross margin to invest in sales and marketing.

In addition, the narrower the range of products you sell, the higher the service quality, and so the more referrals and the higher the confidence of the sales team.

Lastly, you will get more repeat business, which is especially valuable when part of your plan is to sell 100% of your offers to 100% of your customers.

Ironically, top-performing Solution Providers of any business model grow faster and have higher profits, partly by narrowing both the range of customer sizes they pursue and the range of products they sell.

Business Model Specifics

This narrowing of customer size range, and narrowing of products, is generally little surprise to Solution Providers who are already services-centric (regardless of whether their primary service are projects, or Managed Services, or cloud services, etc.). Many of these companies need reassurance that their hunches in this regard are valid, but they have run up against these constraints enough time that the concept – if they haven't already fully articulated and executed it – comes as little surprise.

Product-Centric firms, on the other hand, are often either surprised by this, or have thought about it but dread that it might be true. That's because 50% or more of their gross margin still comes from product resale. They are not accustomed to converting a prospect's request for Firewall X to Firewall Y. They believe (correctly when it comes to product resale), that the more different products and vendors they carry, the more often they can say "yes." This range of product choices lets them serve many different customer sizes.

Are you Product-Centric but seeking to become, not services-centric but "services-led"?

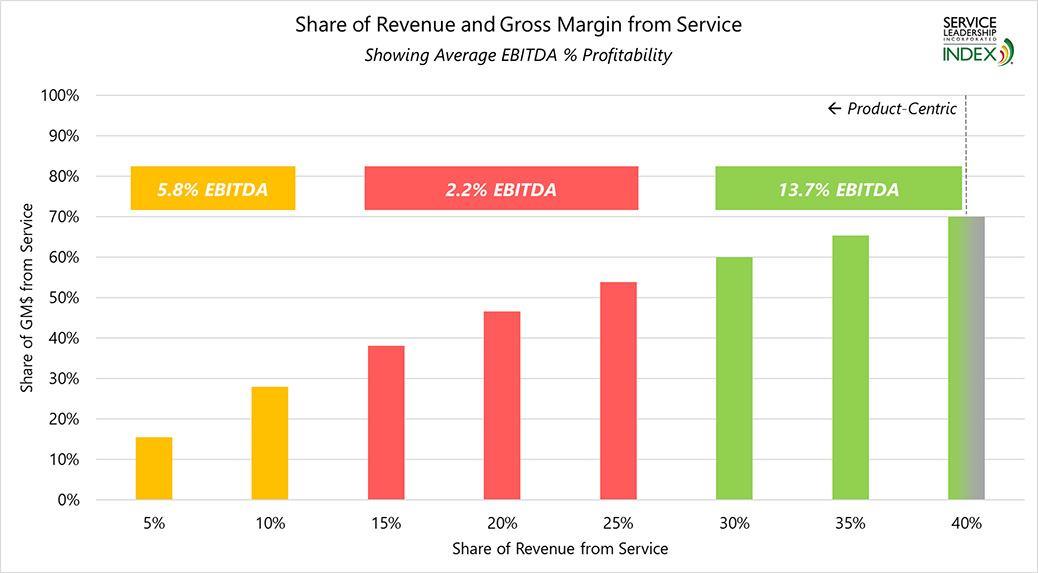

Here's the evidence you need. The Service Leadership Index® ongoing financial benchmark, shows this range of bottom line profitability ("EBITDA %) among Product-Centric firms with increasing proportions of service revenue: