Q8: Use of "Master MSPs”

Questions 6 and 7 focus on the Internet of Things (IoT), but in today's overview we'll skip to Question 8.

We are increasingly interested in whether MSP decision-makers are seeking to accelerate their operational maturity by outsourcing an increasing portion of their operations to "back end” providers such as Master MSPs.

High performing MSPs score high in operational maturity across five areas of their business: strategy, financial management, sales and marketing management, service management and incentive compensation structure. Within these five functional areas, we track 39 distinct operational maturity "Traits” as we call them. Getting to high OML in all 39 is generally not a quick or simple task.

Logically, if growth in profits and stock value is the goal, at least some MSP decision-makers might choose to effectively shift the need to grow in operational maturity in some areas of their business, to someone else. Some MSPs attempt to outsource a smaller or larger part of their marketing and sales process. Some, instead of or in addition to this, attempt to outsource a smaller or larger part of their service delivery, most often their Networks Operations Center (NOC) or their Service Desk (SD) or both.

Traditionally, the use of a Master MSP for NOC and SD services has been positioned by the Master MSPs as a way for the would-be Managed Services operator to enter the MSP business in less time, with less up-front investment and less risk. This is more often than not, the actual outcome; the would-be MSP can focus their time and energy on "only” becoming more operationally mature in strategy, financial management, sales and marketing and incentive compensation, while the Master MSP eliminates much of the need to become more operationally mature right away in service delivery management.

However, we're now well past the 10th year or so of widespread efforts of Solutions Providers to become MSPs. Given more existing MSPs have experience in the business, is use of Master MSPs more common among the higher or the lower performers? Are higher or lower performers more or less likely to consider using a Master MSP in the future? What of those who are higher or lower in OML?

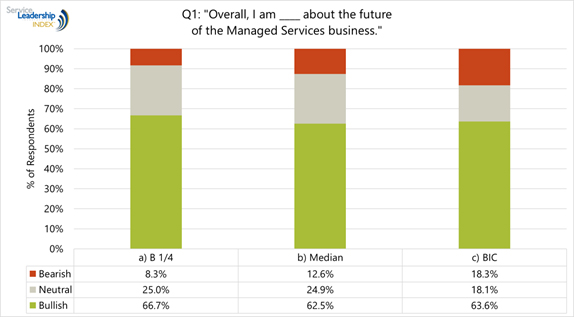

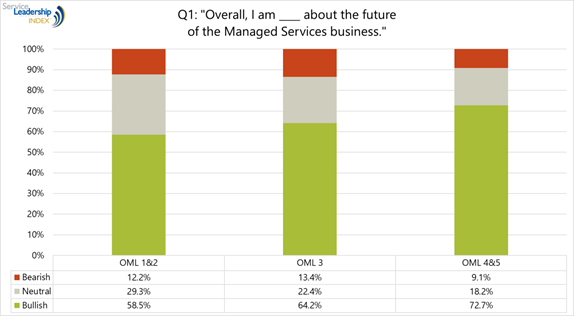

Figure 2: The Future of Best-in-Class MSPs Report™ - Question 1 Response by OML

Figure 2: The Future of Best-in-Class MSPs Report™ - Question 1 Response by OML

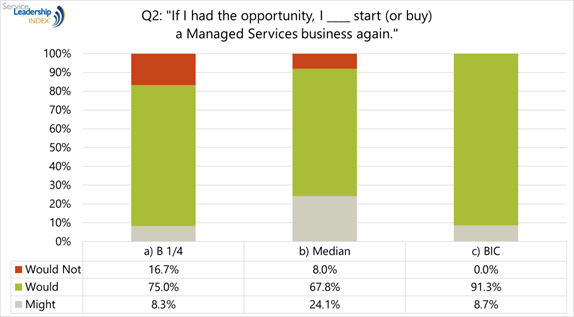

Figure 3: The Future of Best-in-Class MSPs Report™ - Question 2 Response by Profitability

Figure 3: The Future of Best-in-Class MSPs Report™ - Question 2 Response by Profitability

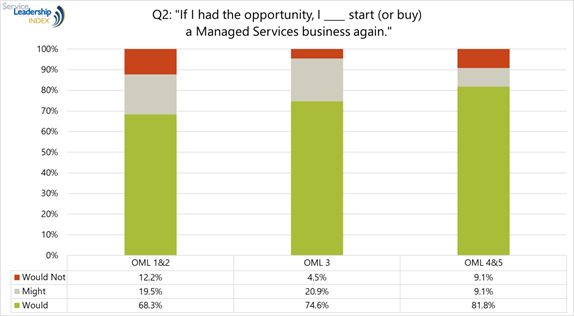

Figure 4: The Future of Best-in-Class MSPs Report™ - Question 2 Response by OML

Figure 4: The Future of Best-in-Class MSPs Report™ - Question 2 Response by OML

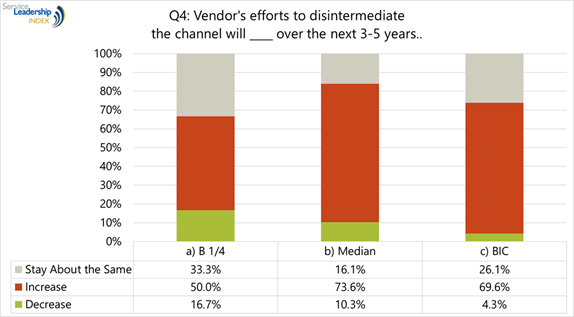

Figure 5: The Future of Best-in-Class MSPs Report™ - Question 4 Response by Profitability

Figure 5: The Future of Best-in-Class MSPs Report™ - Question 4 Response by Profitability

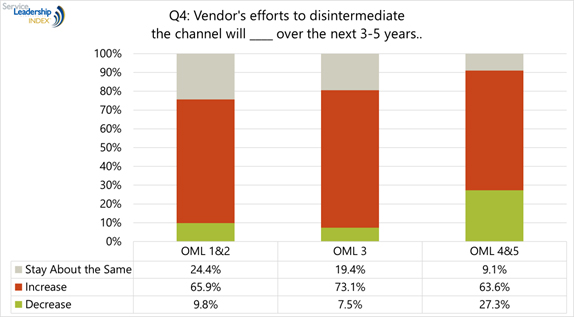

Figure 6: The Future of Best-in-Class MSPs Report™ - Question 4 Response by OML

Figure 6: The Future of Best-in-Class MSPs Report™ - Question 4 Response by OML

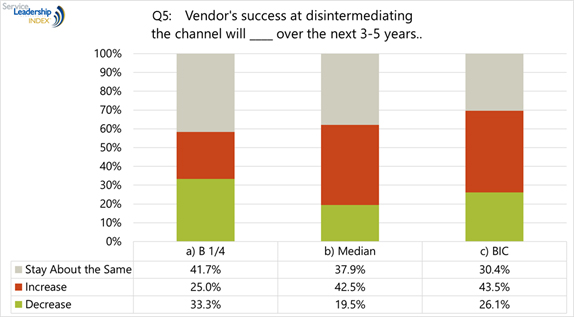

Figure 7: The Future of Best-in-Class MSPs Report™ - Question 5 Response by Profitability

Figure 7: The Future of Best-in-Class MSPs Report™ - Question 5 Response by Profitability

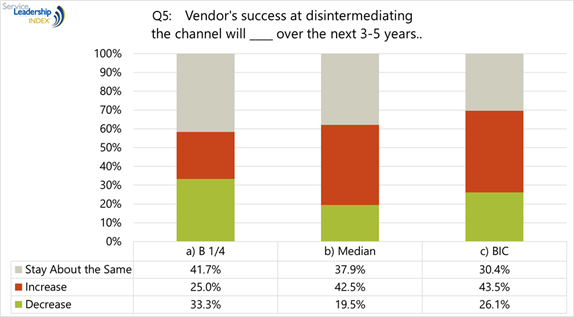

Figure 8: The Future of Best-in-Class MSPs Report™ - Question 5 Response by OML

Figure 8: The Future of Best-in-Class MSPs Report™ - Question 5 Response by OML

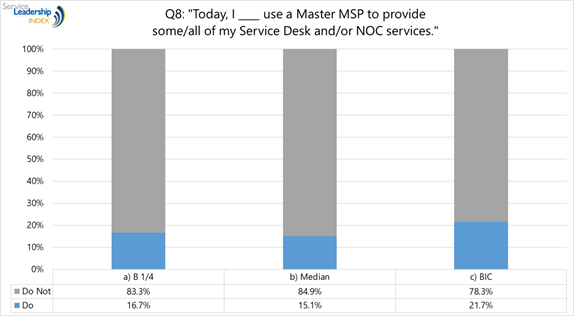

Figure 9: The Future of Best-in-Class MSPs Report™ - Question 8 Response by Profitability

Figure 9: The Future of Best-in-Class MSPs Report™ - Question 8 Response by Profitability

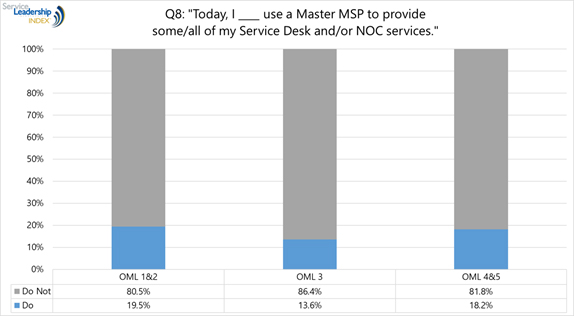

Figure 10: The Future of Best-in-Class MSPs Report™ - Question 8 Response by OML

Figure 10: The Future of Best-in-Class MSPs Report™ - Question 8 Response by OML

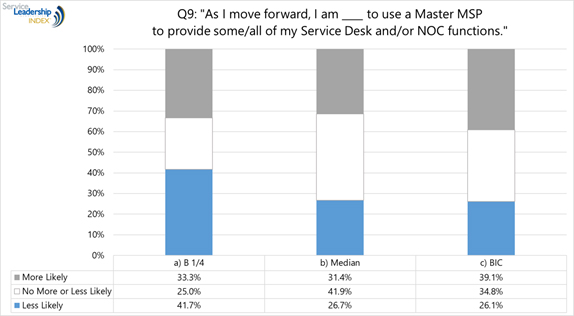

Figure 11: The Future of Best-in-Class MSPs Report™ - Question 9 Response by Profitability

Figure 11: The Future of Best-in-Class MSPs Report™ - Question 9 Response by Profitability

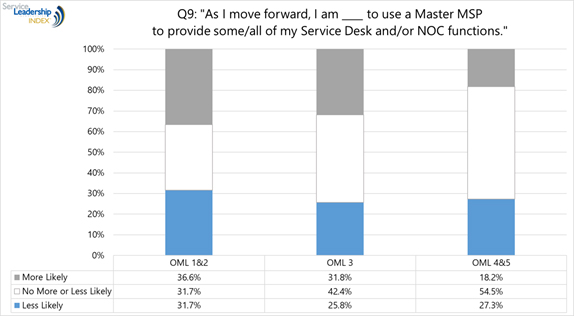

Figure 12: The Future of Best-in-Class MSPs Report™ - Question 9 Response by OML

Figure 12: The Future of Best-in-Class MSPs Report™ - Question 9 Response by OML