A Group of MSPs Agree to Merge Together, Without Private Equity. Why and How?

“M&A” stands for “Mergers & Acquisitions,” but in many cases prospective Buyers and Sellers pass right over “Mergers” and move inexorably to “Acquisitions.” Service Leadership has often counseled that both, in the right circumstances, are equally valid approaches, and that merging, indeed, can prove more advantageous to the right group of like-minded Managed Services Provider (MSP) owners.

Without revealing who and other particulars, we’ll use as our example, a recent engagement in which we counseled a group of MSPs through the process of deciding if, and how, they might come together as a merger of equals.

Contents

Why a Merger of Equals and Not Just Sell?

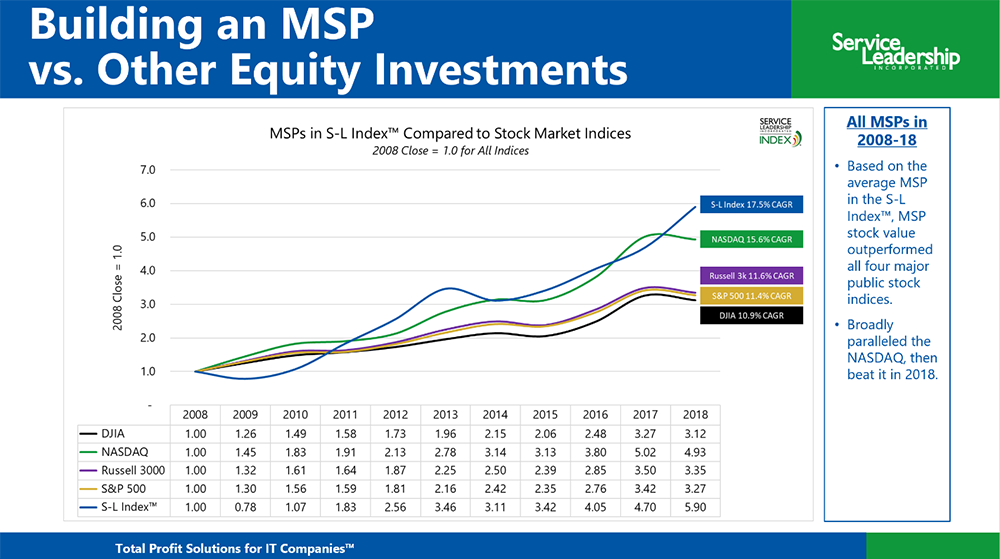

Even at the financial performance of the average MSP, building a Managed Services company has been a productive endeavor for owners.

Based on the Service Leadership Index® – the Solution Provider industry’s leading financial and operational benchmark – and our continual exposure to the Solution Provider M&A market, we estimate the stock value of the average MSP to have appreciated since 2008, faster than any of the major public stock indices.

With that in mind, how could a “self-merger” of like-minded MSPs yield even higher value creation performance?

Let’s start with the economics of being a selling MSP in today’s market. A well-performing MSP might get, on average, 7.3 times adjusted Earnings Before Taxes, Interest, Depreciation, and Amortization (EBTIDA), perhaps as much as 8.0 to 8.5 times if it’s a particularly attractive MSP – i.e., with greater than average recurring Revenue and profitability.

Best-in-Class (BIC) MSP EBITDA currently runs 18.4% of Revenue1, so with, say, $5M in Revenue, an MSP owner would be looking at an exit value of $5M x 18.4% x 7.3, or a $6.75M valuation – and at 8x, $7.4M. Not a bad exit.

But we should ask ourselves, “What are all those private equity firms doing buying up MSPs at these valuations?” The answer is pretty simple:

- If you have $5M or more in total EBITDA and a track record of successful growth – both organic and via M&A (remembering that “M”) – the exit value likely jumps to over 10x EBITDA.

- Indeed, in recent years, MSPs with this level of financial performance have exited at over 10x to as much as 14x EBITDA.

- If the MSP has over $10M in EBITDA, the multiples would likely increase further still.

The underlying reason is that the value of larger, more profitable MSPs rises sharply, as larger (better funded) Private Equity Group (PEG) Buyers are able enter the bidding at $5M in EBITDA, and again at $10M. The ability of these larger PEGs to pay, and to do so with greater levels of debt, increases with EBITDA, which allows them to pay higher prices.

These factors mean that the individual MSP owner, with less than $5M in EBITDA, is often selling to a PEG Buyer (or PEG-backed national/regional MSP) who will roll their MSP into a larger entity that is 50% to 100% more valuable, per dollar of EBITDA.

Not a bad deal ... for the Buyer.

What would happen if that same selling MSP (i.e., $5M and 18.4% EBITDA) resulted from four like-minded, similarly performing MSP owners, who instead merged into a single entity?

- Alone, each MSP owner would have a business worth $6.75M to $7.4M, as noted above;

- As a merged entity, they’d start out at $25M in Revenue (i.e., $5M x 5 MSPs) with 18.4%, or $4.6M, in EBITDA;

- Through successful integration and elimination of redundancies in operations and General & Administrative costs they’d likely improve EBITDA to perhaps 20% or $5M+ in EBITDA; and

- The resulting business would be worth at least $50M and perhaps upwards of $65M.

- That would be about $10M - $13M per MSP owner – about twice the value each owner would get by selling individually.

Not a bad argument for the self-merger approach.

There are at least two additional important advantages in considering the merger approach:

- First: the merging is totally within control of the participating MSPs with no need to raise outside capital.

- Second: The participants avoid the possible negative consequences of selling a controlling share, such as: likely PEG control provisions, redirection of EBITDA dollars to fund debt, and the possibly more profound culture changes that come with being acquired by an outside entity.

Clearly, for those MSP owners who are thinking about their value creation options, a “self-merger” of equals is a strategy that should be considered. The group we advised decided these were compelling outcomes, and that they wanted to proceed to the next steps.

What Conditions Favor a Successful Group Self-Merger?

We won’t cover the usual aspects of M&A synergies and risk mitigation here. They’re important, but there are specifics particular to the group self-merger that are equally important to discuss.

- First, it’s best to have a group of MSPs where the owners have relatively long-standing relationships with each other, as well as a high degree of trust and goodwill. Our example group, accomplished this within a long-standing peer group to which they all belonged. Within this group they found themselves to be the subset of owners willing to consider merging with all that that entails.

- The prospective merging members also would be wise to have the same Predominant Business Model™ (PBM™) – i.e., being truly (and not just aspirationally) MSPs in this case. Each should also be operating more or less at the same Operation Maturity Level™ (OML™). Merging businesses with different PBMs is materially more difficult and therefore riskier and less likely to produce the valuations discussed above.2 Likewise, integrating Solution Providers – even of the same PBM – at materially different OMLs is also riskier. Our example group met these criteria; they had developed as MSPs, together at roughly the same pace.

- In addition to operating at a similar OML, the MSPs should also be taking a common approach to their Target Customer Profile, vertical(s) and packaging and pricing of Services. Ideally, policies, procedures, processes, tools/systems and even culture in Services operations. These will ease post-merger integration challenges and present the largest opportunity for synergies and a rapid restart of forward momentum.

- Perhaps the most important prerequisite is the willingness of participating owners to set aside their egos. They must be amendable to taking on a lesser role for the potential of a greater return, by making the newly combined entity the focal point of success and their ongoing efforts. Our example group performed admirably in this area. When we suggested they pick a leader for the pre-merger phases who would be the candidate to be post-merger CEO, they chose carefully but crisply, and, as it turned out, wisely.

This last point is crucial since the merging owners have to do the heavy lifting of post-merger integration while continuing to grow organically and securing the synergy benefits of merging.

We have advised a number of prospective merger groups as they’ve gone through the process of deciding if and how to merge, often successfully, but with some ultimately– and wisely – abandoning the idea. What are the lessons learned from these cases?

The keys to success lie in identifying the hard issues up front and resolving them before moving on to planning for the actual merger. The five greatest challenges are these:

- Having a clear, shared vision of the purpose of the new company, in terms of value creation, the timeline for that value creation, the business model and go-to-market strategy, and the company culture.

- As previously noted, confirming that there is a sufficient level of fit between the individual MSP businesses.

- Reaching an acceptable valuation for each business, since this will drive the relative share of the combined entity. This works best when the MSPs either have, or can agree on a common financial framework and, perhaps more importantly, the same approach to valuating each prospective merging MSP.

- Determining which location(s) will house what soon-to-be-centralized, customer-facing and internal Services, and which will no longer have those Services?

- Getting all the MSP owners to agree on the leadership and organization for the merged entity – e.g., Who will be the CEO? What are the roles and responsibilities of each owner and their key executives? And who, perhaps, doesn’t have an ongoing role?

At this point, the issues of fit, valuation, consolidation and leadership/organization were resolved within our example group. They now moved to the detailed planning required to ultimately execute a successful merger. This included:

- Building a realistic financial plan – i.e., for each significant item of Revenue and Cost – starting with the current individual performance of each MSP and building out at least the first two to three years from the point of merger;

- Developing a detailed, pragmatic integration plan for each significant aspect of the business down to the tool sets and key business applications; and

- Securing and iterating the necessary merger agreements early in the process – which will surface additional discussion items and issues that will need to be worked out.

Not surprisingly, the process of working through all of these tasks often works best if moderated by a neutral party – if not, then one of the principals must facilitate the process which puts that individual in a potentially awkward position of trying to be an unbiased moderator while simultaneously advocating for his or her own interests.

What Post-Merger Milestones Must Be Met to Secure the Highest Future Exit Value?

The most lucrative exit for the shareholders of the merged company, after perhaps 2 to 5 years, is likely to be to a large PEG. What will the PEGs, or any other experienced Buyers, most likely want to see as a track record for the merged MSP?

The prospective deep-pocket Buyers, will want to see that the leadership has created a company that has continued to grow at a good pace, and has generated not only increased profitability from the initial synergies, but sequentially improving profitability from there.

They will certainly want to see material organic (i.e., non-M&A) growth. The Service Leadership Index shows that, from 2008 through 2018, the top-line Revenue CAGR of the average MSP has been 8.6%. The prospective Buyers will want to see consistent organic growth in existing markets and in any new markets opened without an acquisition (i.e., in “greenfield” markets), above that average rate.

Because the prospective Buyers are likely to want to accelerate that growth with even more acquisitions, they will also want to see that the merged MSP has been capable of successfully buying and integrating other, smaller MSPs along the way.

With these three characteristics exhibited:

- Initial synergies and ongoing scale,

- Ability to grow organically, and

- Ability to grow via acquisition.

The merged MSP will provide the most compelling case to prospective Buyers and thereby likely earn the highest price.

The Overall Project Plan for Deciding, Executing and Successfully Exiting

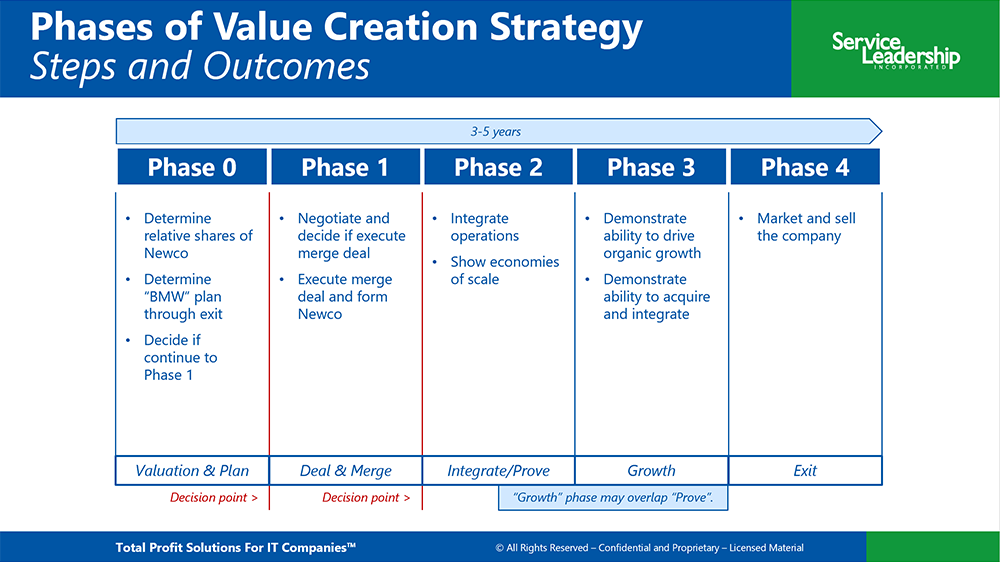

The project plan we suggested, advised on and facilitated for our intrepid group of MSP owners is shown in the chart below.

Note there were two decision points (red text) at which the owners were required – by good business judgment – to make a conscious decision to either continue forward or stand down.

In mergers (and acquisitions), one can only decide to take the next step; one cannot decide at the outset that one will go all the way to a closed deal.

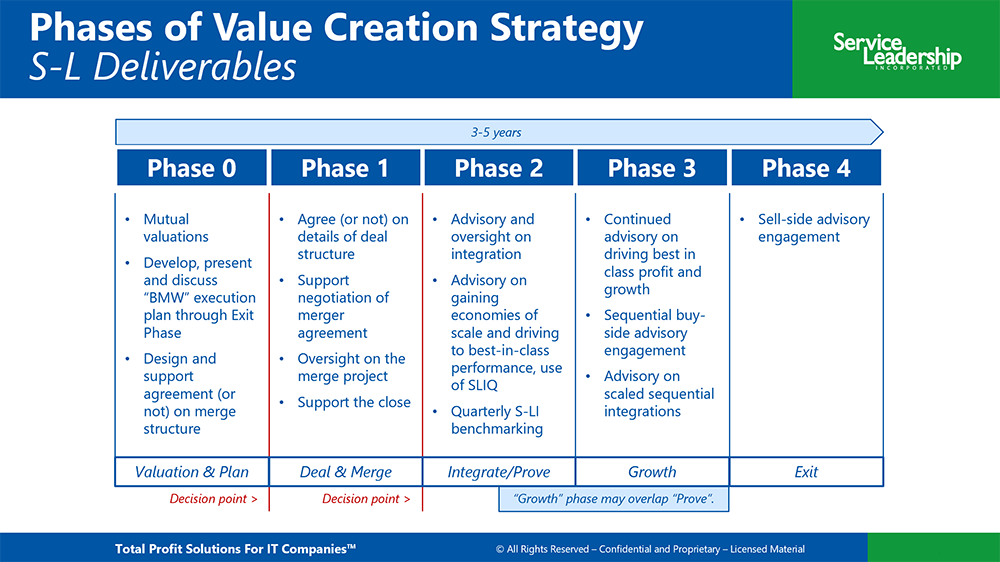

To be more specific, the chart below shows the deliverables that Service Leadership provided during each of the above phases.

Our example group, did indeed choose to proceed at each of the two decision points, and have successfully merged. They are generating the targeted synergies. In addition, they have been surprised at the level of attention they have already received from PEGs. Despite some attractive offers, they have so far decided their future value will be materially higher, and are staying the course to tackle the phases described above, albeit, they are of course open to conversations.

In summary, for the right group of like-minded MSP owners, in the right conditions, a merger can prove to be a materially more lucrative approach than simply being acquired. However, the owners of prospective merging MSPs need to make sure that:

- The necessary conditions are in place for a successful merger and eventual exit;

- They identify the hard issues up front and resolve them; and

- They invest in the careful and detailed planning before merging and executing post-merger.

Service Leadership welcomes the opportunity to discuss the prospects of a group self-merger with interested owners and executives of MSPs worldwide. Please feel free to contact us at any time, to discuss with a Service Leadership Senior Client Advisor.