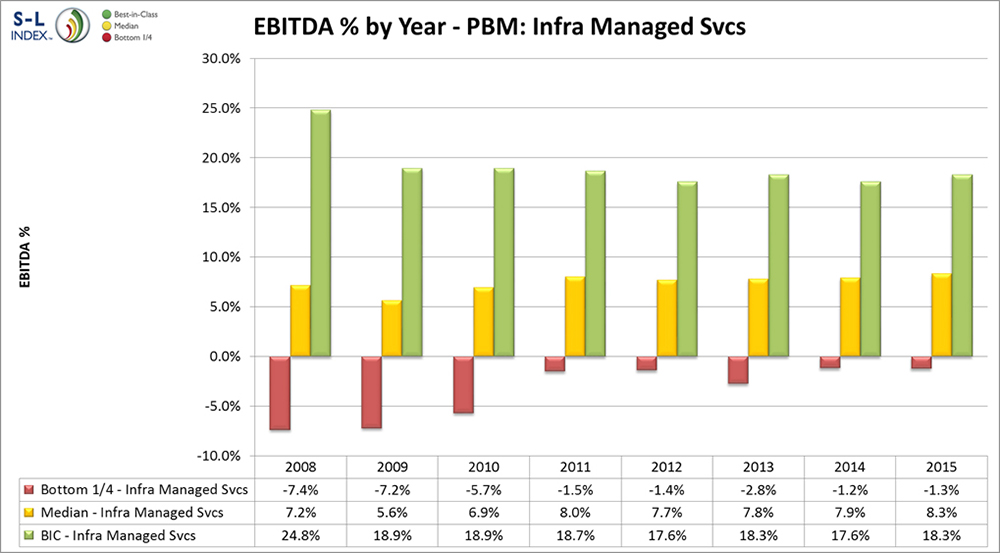

As you can see, one quarter of MSPs have earned about 18% adjusted EBITDA each year since 2009, across all markets, and all sizes and ages of MSPs. During that time, the Median has risen from 5.6% to 8.3%. Unfortunately, in any given year, one quarter of MSPs lose money.

This is true in your market. How do we know? We are by far the largest benchmarker of IT companies, and so we have benchmarking and/or consulting clients and/or peer group members just about everywhere. And, we've been in the business over 30 years. For the first 22, we operated IT companies from $50mm to $2bb, likely in your market.

Clearly, with one quarter of MSPs making good money, one quarter losing money, and the rest somewhere in between, in every market, the reasonable conclusion is that some MSP executives are formidable competitors, and some are not.

When you meet with IT company owners and executives, they probably seem to know the IT business better than you do. Don't they have some natural advantages in competing with you?

Yes, but you also have advantages over them, in the IT business.

What They Have Over You

The one advantage almost all of them have, is that they know IT technology. A large proportion of IT company owners and executives have technical backgrounds. They can talk expertly about IT technology.

This is enough to allow even those with the least business and leadership acumen and/or desires, to build a $1mm to perhaps $3mm local MSP business. There are many of these.

Unfortunately for those who wish to be bigger, technical acumen is only about one-fourth of what is needed to grow an IT business beyond that, and make good to great money in the process. Acumen is also needed in:

- Business management,

- Leadership,

- Financial management.

As with any other group of entrepreneurs, their natural capabilities in these vary widely, this explains the benchmark results in the chart above.

The IT business — at least that portion of it where most Copier Dealers are pursuing IT — is about where the automobile business was in, say, 1910. Back then, car dealers were small, and most car dealer owners weren't business people. They were "techies." They liked gasoline motors. They liked being automotive pioneers. They were enthusiastic and knowledgeable about the technology. Many – not all – went by the wayside when people with better business skills and higher financial goals, entered the business.

It's important to understand that the barrier to entry in the IT business is low. All you have to do is lose your job in an IT department, hang out your sign and start charging $50.00/hour. You will likely make more money in your first year than you did as an "IT guy" in some company. Your parents will probably think you are going to be the next Bill Gates. But, with all due respect, that's a far cry from building a sustainable, scaled business.

In our master database, we have over 36,000 IT companies. About one-third of those are, objectively speaking, materially in the Managed IT business. Nearly 85% are under $10mm in revenue; nearly 80% are under $5mm in revenue. Most of them have little formal business training or experience.

Don't get us wrong. These are our people. We love them. We help them accelerate, too. On average, they are getting larger. As you can see from the profitability chart, the Median are gradually getting more profitable. Even the Bottom Quartile are having fewer and lesser lows.

What Advantages You Have

We mentioned you have some formidable advantages as well. They are:

- Your own business acumen as compared to that of the IT companies in your market. If you are earning median (or better) bottom line profitability and growth in your print business, you are likely as good or better a business person than half the IT companies in your market. If you do not regularly attain median (or better) profitability and growth in your core business, our advice would be to not get into the IT business – or any other new business – until you do.

- You understand how to manage a sales force. As you may have deduced by now, the typical owners and executives of local IT companies, have little experience and success at managing sales people, much less a team of them. Most believe (falsely of course) that it cannot be done.

- You understand equipment financing. By now you probably know or have heard, that a key to success in the Managed IT business is to "rip and replace" any IT equipment the customer may have which doesn't fit their standards. This is for the same reasons that most successful Copier Dealers don't sell a mish-mash assortment of lines. Nearly all Managed IT companies are selling all that new equipment for cash. Few understand the advantages of financing and fewer still know how to sell it. Yet without the "rip and replace", it's not possible to provide good service and make money. Your knowledge of financing helps Copier Dealers get the new equipment into place with best-in-class speed and adoption.

- You understand field service operations, financials and quality. IT companies that were started in the 1980's and mid-1990's understand field service about as well as you do. Those started afterwards, which is about half of them, do not. Although much of the Managed IT workload is indeed centralized in your Service Desk and Network Operations Center, there is still a fair bit of field work to be efficiently done. Also, many of the service metrics you manage in your copier business, are either the same in the Managed IT business or have close corollaries.

- You understand the selling and servicing of print technology is only partially about the technology. Many owners and executives of IT companies do not understand that the Managed IT business is only partially (fractionally, in fact) about IT technology.

- You have a contracted customer base. A $5mm Managed IT business will have about 60 or so contracted small business customers. A $20mm one will have about 250 or so. You have thousands or tens of thousands. The Managed IT companies in your markets are, right now, diligently calling on your contracted customers. Not all your customers are good targets for Managed IT – about 20% to 25% of them are. You have a trusted relationship with them. They pay you every month. Any Managed IT company would die to start with that type of relationship.

To be sure, the Managed IT business isn't a cake-walk. It's hard work. For the most part, the least and most successful IT company owners and executives spend 110% of their waking hours keeping their companies on track and headed to the next level, just as you do. This is one reason we say, be sure your core business is at median performance or better, before you dive into the Managed IT business. This isn't a "toe in the water" thing. You'll lose your foot or your leg.

The Real Disadvantages That You Have

What are the real disadvantages in getting into the IT business? They're just as you would expect or may have by now deduced:

- You don't know what you don't know. Risk management options:

-

Seek qualified help.

-

Hire an IT leader with demonstrated business management success in IT entrepreneurial situations pursuing the target client size you are pursuing. Word to the wise: the owner of the IT company who just sold his company to you, may or may not be that leader.

- You're trying the wrong sales model. More on this later in this newsletter.

- You haven't fully figured out that your first and most important sale is to your copier reps and their managers. They are the keys to your best shot of getting to a meaningfully sized IT business in a significantly short period of time. They are your future, not your past. But – you must harness the sales team properly (see #2, above).

- You set your ROI goals for Managed IT too high too soon. If you don't have three to five years to get to good cash flow and stock value, don't start. Leave it for the next owners. Yes, the choices of "build, buy or partner" have a material impact on degree and timing of investment and return.

As always, the first step is to be aware of these disadvantages. For the prudent operator, these disadvantages are navigable. This is demonstrated by the increasing number of Copier Dealers who are increasingly successful in the IT business.

Why Using "Common Sense" About Your Sales Model Backfires

If adding a materially new line of business to a traditional sales force, were a new thing, one could forgive the fact there are too many consultants in this business giving bad advice about how to do it.

Let's get back to basics.

The OMLs of Adding a New Line of Business to a Traditional Sales Force

You'll recall from earlier in this newsletter, "OML" stands for Operational Maturity Level. We mean there are more efficient and effective ways of generating growth and profitability, as well as less efficient and effective ways to do so.

We measure OML across all the important aspects of the business. We know what the more successful folks do, and what the less successful folks do.

Given time, many of the less successful companies learn how to do things more like the more successful ones have learned to do.

Service Leadership's job, is to accelerate the speed with which you recognize where you are on the path, and, if you wish, to accelerate your progress by showing you the successful way. We can steer you around the pitfalls and blind alleys, providing reassurance (or cautions) along the way.

So, what are the OMLs of growing a new line of business when there is a traditional sales force and a traditional customer base?

We'll start with the presumption that your strategy is not to focus on winning new customers to your company as the primary way you will grow your IT business. However, you certainly should try to win new customers through IT (and then convert them to print customers). Hopefully you have not incorrectly concluded that your current copier base isn't a great place to sell Managed IT.

(And hopefully you have not incorrectly concluded that you should not risk doing so because your IT service quality isn't good – your IT service quality can and should be good. Hint: Enforcing your technology standards is the only proven path to quality and profit in the Managed IT business.)

Therefore, you wisely want to leverage your existing copier customer base to sell Managed IT.

What is the typical learning curve of organizations that accomplish this happy ending?

The Low OML Approach to Selling Managed IT to Copier Customers

The usual first approach to selling a new line of business, like Managed IT, to the traditional customer base is the "common sense" one. This is to "train the copier reps on IT." This approach not only fails to drive IT sales, it often backfires because it negatively impacts revenue growth in your print business.

The reason it fails to drive IT growth isn't because copier reps aren't capable of learning how to sell IT. Most are – just like most (but not all) IT sales reps are capable of selling IT.

Here are the reasons why training the copier sales people to sell IT fails to drive IT revenue and profitability:

- It takes longer to train anyone to sell IT than the time you have to get to profitability,

- Sales reps in training either start selling the new thing slowly or quickly, but they most often sell it badly. By badly we mean:

- They fail to convince the copier customer or new prospect that your company knows anything about IT. Worse, they especially fail to convince the 20% to 25% of decision makers who you want to have as Managed IT customers because they're smart business people who can smell a beginner sales pitch a mile away.

- If, heaven forbid, your newly educated sales rep actually closes a deal, the odds are high that the customer's expectations, and yours, have been materially misplaced. Meaning, you will disappoint that customer, and they will disappoint you, as will your profitability. This is not a sales game for beginners.

Meanwhile, the time spent out of the field being "trained on IT", and the copier reps' time budget for sales calls being increasingly consumed by "selling IT," they are spending less time selling print, and your print revenue growth backfires.

There are other, corollary outcomes which are only slightly less dire:

- Any Managed IT deals you sold this way likely resulted in the clients concluding you deliver bad service (whether that is merited or not), which makes it harder to convince copier reps to sell Managed IT. Or they may even do so little as to hand over leads to someone who can.

- Your staff will arrive at all sorts of false conclusions that come from too little experience, too few closes and too few happy customers:

- "We're over-priced,"

- "Our customers don't want Managed IT,"

- "We can't convince them we're not just a copier company."

And similar poppycock.

All of this leads you to believe that, while others must be getting their copier reps to sell IT (they're not), your reps for whatever reason, are not able to do so.

Will your copier reps ever learn to sell Managed IT on their own? Yes. Once they have ridden shotgun on ten (10) closed Managed IT deals in their existing customer base, which have been properly sold in the high OML way. Only then will they be able to reasonably qualify, pitch and close a smaller Managed IT deal on their own. Eventually, they'll even learn how to successfully and safely sell bigger deals.

Do not let them try to sell any Managed IT deals, under any circumstances, until they have reached ten (10) closed managed IT deals the proper, high OML, way.

Anyone who advises you to train traditional reps to sell IT directly, has never successfully gotten a materially new line of business off the ground in a traditional business. Probably they have never even had the opportunity to try.

The Mid OML Approach to Selling Managed IT to Copier Customers

Once they have tried and failed with the low OML method, and correctly concluded their copier reps shouldn't be trained to sell Managed IT, many executives then decide to build a separate IT sales team:

- "If my copier sales reps and manager won't do it, or they're too distracted by it, then by gosh I'll hire IT sales people to get it done!"

This also seems like "common sense", and it works, for a time. Your IT sales will go up.

However, the more successfully this increases IT revenue, the more problems it creates. Within a meaningfully short period of time, those problems will become unmanageable to the extent that you will either "cap" IT revenue one way or the other, or you'll seek out the high OML way.

You might say, "Well, if IT revenue goes up, then whatever problems that creates are good problems to have."

Maybe. That is the winning entrepreneurial mantra, right? Then again, there are some problems not worth creating because the cost of solving them, and the risk if you don't solve them, are too high.

You decide:

- Customers (especially good ones) get confused when they have two reps from one firm — a copier rep and an IT rep — calling on them. "Why do I have to repeat myself to each of them? Why do they not know what each other is doing?"

- Understandably, the customer only has time to build a relationship with one rep. Generally, they will pick the rep who represents the offerings that have the most consequence to them. That is generally the IT rep. Once the copier rep realizes he or she is being left out — by the customer — they will do everything they can to keep the IT rep out of "their" accounts. This is one reason some copier companies mistakenly end up selling IT to only new customers.

- To try to mollify the copier rep's concerns about "bringing in" (or even "allowing in") the IT rep, you agree to split the IT commission between the copier rep and the IT rep. This helps for a bit with the copier rep, but they still get left out by the customer. And it doesn't help with the IT rep who is doing "all the selling." So, you will probably think about paying, and possibly end up paying, full commission on the IT stuff to both reps. Which you can't afford.

- No matter what you do, the copier reps will (rightly) conclude you are not investing in their futures. Now, many of them are "old dog" reps who have no interest in selling IT, but more and more of them are not. They actively want to sell IT; you want to show them a path to selling both.

- In terms of base pay, commissions, management time, back office resources — you name it — it's expensive to have two sales reps calling on one customer, especially if one sales rep will do!

Two sales teams calling on one set of customers? Talk about cost. Talk about complexity for you and the customer. Talk about damaging your personal grief-to-profitability ratio.

The High OML Approach to Selling Managed IT to Copier Customers

Some executives work their way up through these OML levels. Some go right to the higher OML approach. Either one is fine with us, we're happy to help at any stage. We're always happy to see you be more successful sooner and with less investment and risk.

The Importance of Service Quality

It is important to understand that the foremost objective at this stage of your Managed IT evolution — and forever — is that you deliver high quality service. Everything else is subordinate. The reason for this is, if you disappoint a customer, you then disappoint the rep. And if you disappoint the rep, they will never bring IT into another account. They will tell the other reps. Then, your ability to leverage your contract base, and even to sell to new customers, is dead in the water.

Service quality is everything. You know this, too, from your core business. Therefore, you must charge enough to be able to afford to deliver quality. Even if everything else that would allow you to deliver quality lines up — right Target Customer Profile, right technology stack, the whole bit — if you can't charge enough to be able to sustainably do a good job, don't close the deal.

The Successful Sales Model

Here is the sales model used by top performers to sell Managed IT through the copier reps to the contract base:

- Copier reps turn in company and contact names on pre-qualification forms.

- The pre-qualification form has about 15 questions that the copier rep must complete, about 10 of which require talking with the company/contact.

- The copier rep should not be trained on what the questions mean, or why they are being asked. They should not be put into the position of having to seem like they know what they are talking about. They also should not be trained or allowed to "score" the company/contact on their own; that solely is the SME's domain.

- Subject matter experts ("SMEs") working for service but spending 100% of their time with sales, perform the initial and final qualification.

- The company/contact isn't a "lead" until the SME preliminarily decides that it is someone who fits your Target Customer Profile and can be safely and profitably sold the Managed IT services you offer. Otherwise, it is just a name of someone who wants to buy something, but not necessarily something you do.

- The SME must follow your established formula for scoring the 15question pre-qualification form. Once so scored:

- If the score is too low, the copier rep has at least earned an explanation as to why. If the copier rep would like, they can ask the SME to have a phone call with the company/contact, even though both they and the SME know the company/contact is highly likely to not be a lead. The copier rep must expect the call to end with no appointment or effort at selling. You are standing down this company/contact.

- If the score is in the middle, the copier rep has earned a SME phone call 100% of the time. This is not yet confirmed to be a lead, much less a qualified one. At the end of the phone call, the SME will decide if it is a lead and is at least possibly qualified. If those two things are true, a face-to-face SME meeting with the (now) prospect is scheduled. The copier rep should go but is not mandatory; the SME will update the copier rep at all times.

- If the score is high, the same things happen as in the step immediately above. We just know more good things from the pre-qualification form, before we have the phone call. Even with a high score, this company/contact is not a lead, until the SME determines whether it is or not, during the phone call.

- If the SME decides the company/contact is not a lead, it is the SME's responsibility to decline to keep going, with sufficient grace and diplomacy to make sure they have not embarrassed the copier rep or been off-putting to the customer. The script is something like: "Thank you very much for your time. Based on what we've discussed, we don't believe we would do the kind of job for you, that we traditionally and habitually do for our customers. That's why we have such a great reputation. Thanks again for your time." The value of the conversation with the SME will be a reward for the company/contact, even though you do not continue.

- The pre-proposal assessment is charged for, and is performed by the vCIO ("virtual Chief Information Officer"), who also works for service.

- The vCIO will also lead the on-boarding, and will "farm" the account.

- The proposal is pitched and closed by the SME. The copier rep can attend the proposal meeting.

- The copier rep must not close or negotiate the deal.

- The SME has a responsibility to shut down the deal if it is unsafe, even at the last moment before the decision maker signs the contract. This is because, even with all the qualification, the paid assessment and all the other pre-work, it is not uncommon for something to arise at the last moment which could make it hard to deliver quality. Here's an example:

- The decision maker is about to sign the contract. He or she has pen poised above the signature line, but looks up and says, "Oh, I forgot to tell you. We just bought a little company who uses all Apple Macintoshes. They will only make up 10% of our workforce. You can handle that, can't you?" You cannot keep this customer happy, and you cannot afford to have an unhappy customer. This happens about 5% of the time when you're doing everything right (i.e. at high OML) and about 20% of the time when you're doing everything at low OML.

- The proper response by the SME is to decline the contract, "Thank you very much for your time. Based on this new understanding, we don't believe we would do the kind of job for you, that we traditionally and habitually do for our customers. That's why we have such a great reputation. Thanks again for your time."

- The vCIO who was introduced when they led the assessment, leads the on-boarding and, as the technical account manager, if you will, leads the Quarterly Business Reviews.

- The copier rep gets 100% of the commission, and all the glory and recognition. The SME and the vCIO are paid incentive based upon the degree to which the IT line of business hits their growth and profitability goals. They are not — under any circumstances — paid a commission on a deal basis.

- You might say, "What about new customers, who don't buy copier from us today? Who calls on them?" Answer: Copier reps using the exact model above. Don't add IT reps and not the SME or vCIO on their own. Remember, you are trying to convince the copier reps that you are investing in their futures.

This is a high-level outline of the method used by the companies that successfully add Managed IT without risking damage to their copier revenue growth, and without incurring the cost and dissension that results from the "two sales forces" approach.

Obviously, the outline above is mostly "what to do", with a little "why" and an even smaller amount of "how." Not everything is free.

That said, if you do what the outline above instructs, you will have saved six to seven figures, and many fiscal quarters, and your grief-to-profitability ratio will make you smile sooner.

With all due respect, treat these instructions like my golf coach tells me to treat his instructions: "Stop thinking and just do what I tell you to do. You will shave strokes off your game and have more fun."

This Has Worked Before, and It's Worked for You Before

When is the last time you successfully added a materially new line of business?

We're not copier company experts, nor do we represent ourselves as being so. We are experts in helping copier companies succeed at adding Managed IT.

We've learned a bit of history about your business from you:

- Copiers were initially black and white. How did you successfully transition to selling color? Did you train all the reps on how to be color experts? No. Most of you hired "color overlays" who did the color selling until the down the street reps learned by example how to sell color. Now all your reps sell color.

- Copiers were initially not digital and not connected to the network. How did you successfully transition to selling digital? Did you train all the reps on how to be digital experts? No. Most of you hired "digital overlays" who did the digital selling until the down the street reps learned by example how to sell digital. Now all your reps sell digital.

Your progression into selling Managed IT is the same, with some important exceptions:

- If you sell the wrong thing in color or digital, it's usually not the end of the customer's business, nor is it a huge cost exposure for you. If you sell the wrong thing in Managed IT, it could well take the customer's business fully or partially down for a day, or even days. More than once.

- It will surely cost you a great deal (many times more than the contract revenue) to support them until you can get them to move to a different provider.

- For these reasons, the SME must report to service, not to sales. This is not a game for "sell it now and we'll figure out it later." If you take that approach, you will burn customers and therefore burn reps, and your IT business will be considerably more challenging that it needs to be.

So, you've likely used this model successfully before, in the color and digital transitions.

As have others. The high OML sales model also works for other companies in other traditional businesses who are trying to add Managed IT.

The first ever example is the original "Big Iron" company itself: IBM. In the early 1950's, IBM more or less invented the commercial computer business, with great success. Their sales team was the quintessential "big box" product sales model — heavy on quotas, aggressive management, massive "box" sales. You know the drill.

By the late 1970's it was becoming clear that just selling hardware wasn't going to cut it anymore, and that IBM needed to transition to adding services, including what would be called today, Managed IT. After some floundering around with current management, the board picked Louis Gerstner, CEO of RJR Nabisco, to take the helm at IBM.

Much to everyone's amazement, "Lou" from the cigarette-and-snacks company figured out the high OML sales model, and it worked. Meanwhile, a whole bunch of IBM's competition, tried either the low- or mid OML model and so didn't succeed soon enough. They either disappeared or become much smaller.

Other examples abound:

- Fast forward to the personal computer era, and the primary model for IT companies then was to resell tons of boxes — become an IBM, HP, Compaq, etc. dealer (called "partner" in the IT business). Soon enough, it became clear that you couldn't make money unless you also sold services. Many of those partners tried the low- and mid OML method of adding services and didn't succeed soon enough. Most are gone. Those who used the high OML method, such as CompuCom, exist and flourish to this day.

- The business telephone industry (those who sold, installed and supported PBX and similar phone systems), went through the same transition as copier dealers — the one from analogue to digital — in the late 1990's and early 2000's. Those who used the high OML sales model, are mostly still around and doing well, including their Managed IT. Those who did not, are mostly not around or not doing well.

This isn't "our" model. It's the just the model we've used successfully in four companies. It's the one we've observed to have worked the best and quickest in the other companies who successfully added material new lines of business. It has helped most of our clients be successful and safe.

How Well Are Copier Dealers Who Are Pursuing Managed IT, Doing?

In late 2013, with GreatAmerica Financial Services, we formed the S-L GAMIT peer groups of Copier Dealers who are doing or who wanted to do IT. As part of their membership, we benchmark them quarterly — their entire company and their IT business within it.

The few larger ones who were already doing substantive IT at that time, were doing fairly well with it. They continue to do fairly well or better, albeit not without some of the challenges faced by some other IT companies.

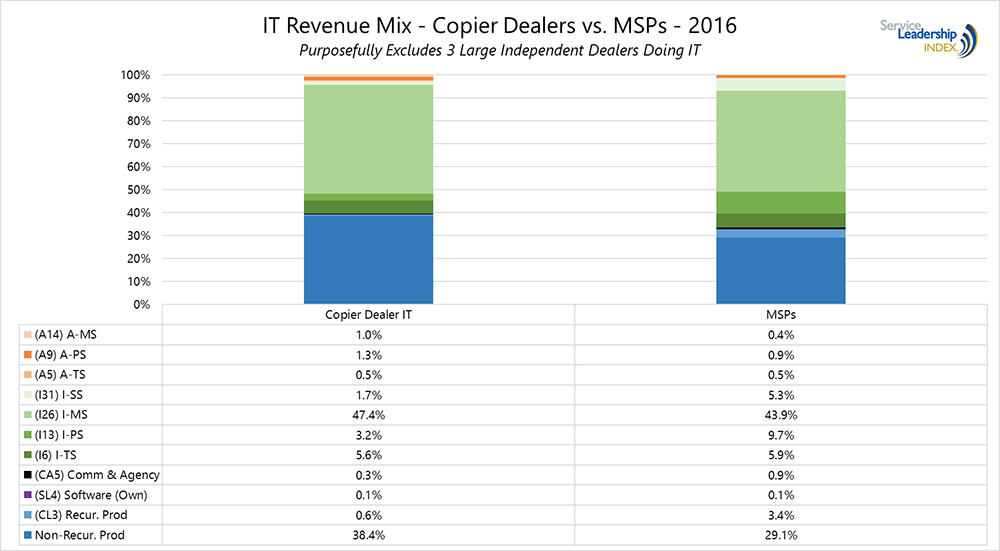

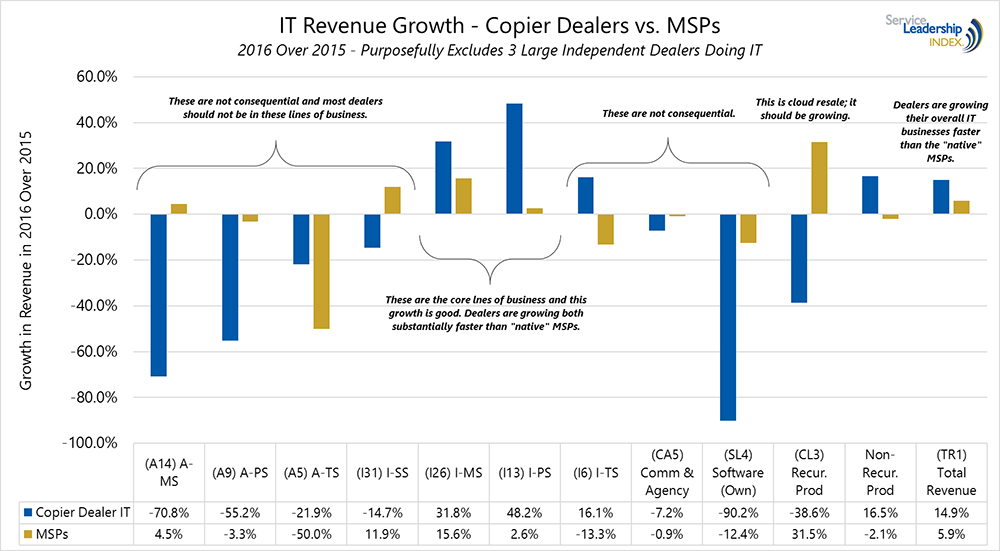

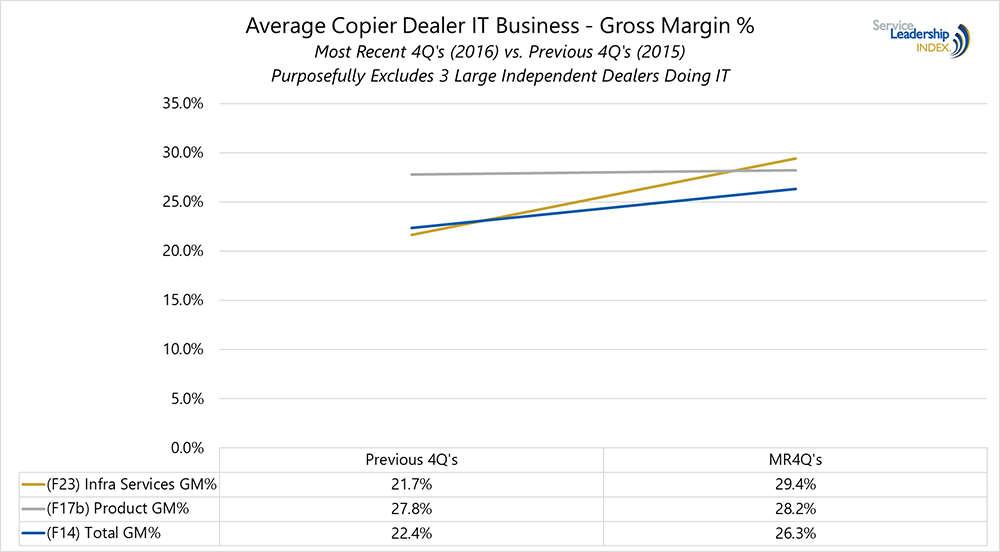

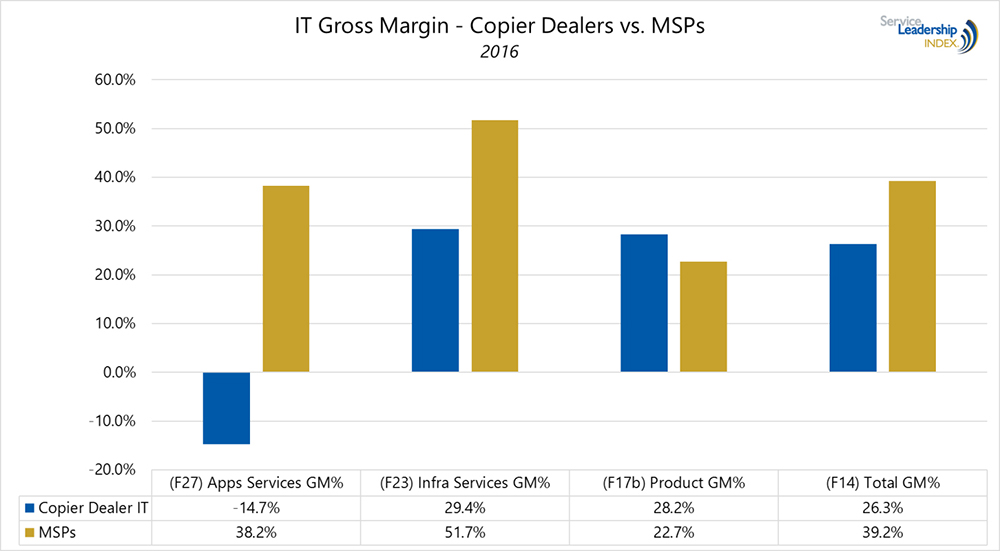

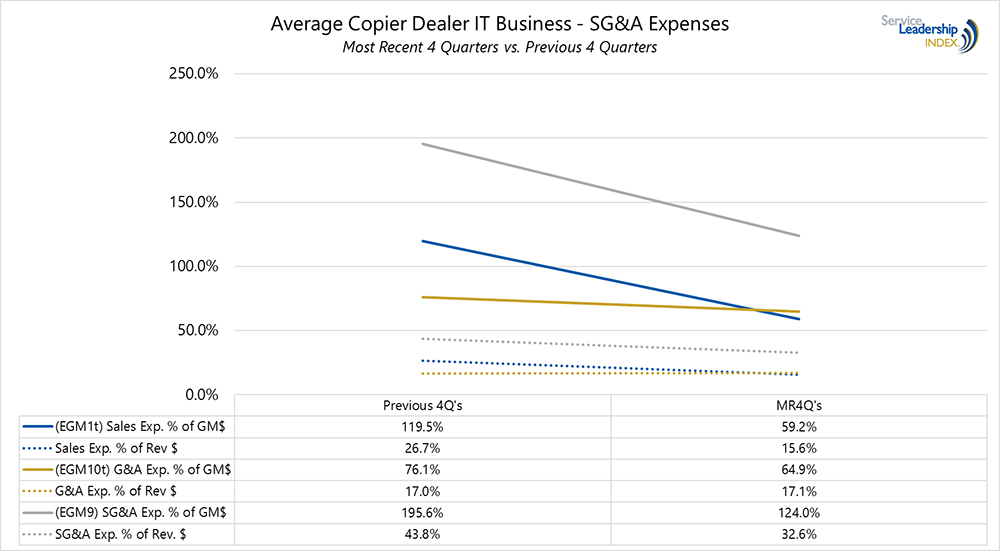

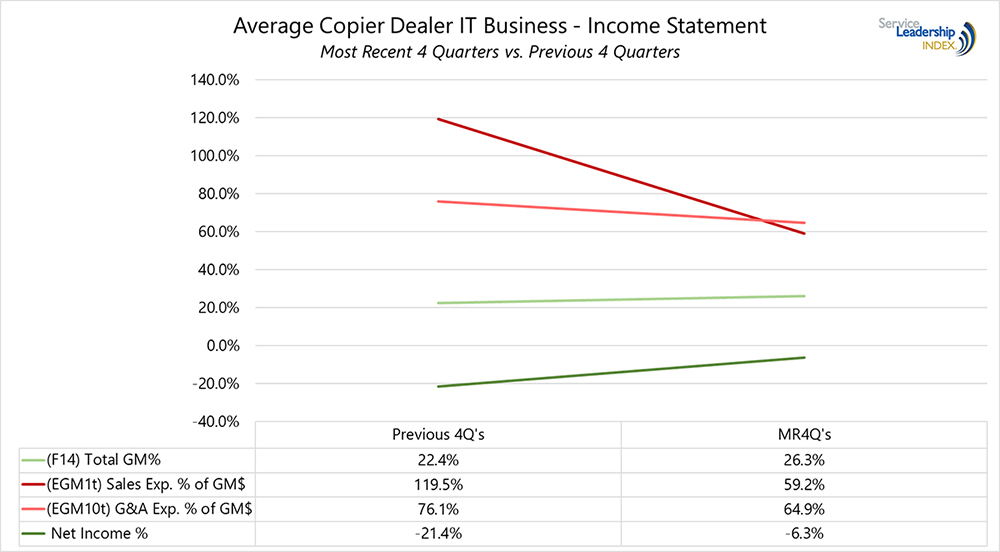

The real question is, how are the Copier Dealers who when they joined had little or no IT, doing today? To answer this question, the data that follows purposefully excludes three large independent copier dealers who have been doing substantive IT all along, because we want to show you how the “newbies” and smaller ones are doing.

The year 2014 for these smaller Dealers was indeed a bloody one from an IT profitability standpoint:

- Gross margin on their IT services was generally negative, regardless of whether they chose the build, buy or partner approach to establishing service delivery capability.

- Our benchmarking system enables them to accurately allocate Sales and Marketing cost specifically to their IT business.

- We then allocate General and Administrative dollars to their IT business unit in proportion to the revenue their IT unit generates relative to the entire company.

In 2014, the Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) of their IT businesses — again leaving out the three "big guys" who had substantive and successful IT businesses — was negative 2,041%.

That large percentage — though obviously not good — should tell you that the actual dollar amount of the losses was relatively small as compared to their overall business. None went out of business because of it.

It should also tell you that they were, and most expected to be, in investment mode.

How, then, did the new-to-IT Copier Dealers do in 2015 and 2016?

Revenue Mix and Growth

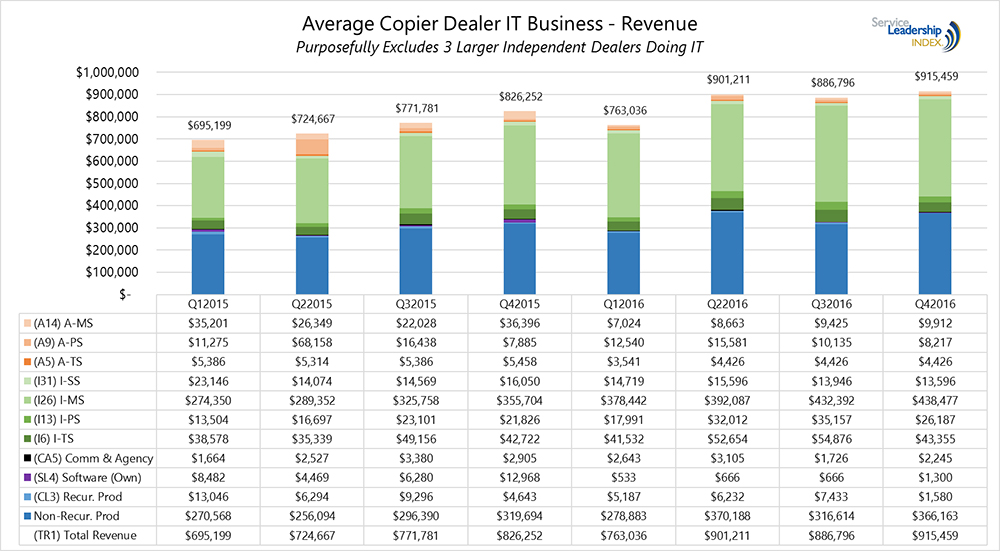

The chart below shows the revenue mix and revenue growth of the average Copier Dealer doing IT (remember, we purposefully left out the "big three" so we can see how the newbies and the smaller ones are doing). The chart shows the eight quarters of 2015 and 2016.